انڈیوڈوئل انشورنس

بنکشورنس

کارپوریٹ بینیفٹس

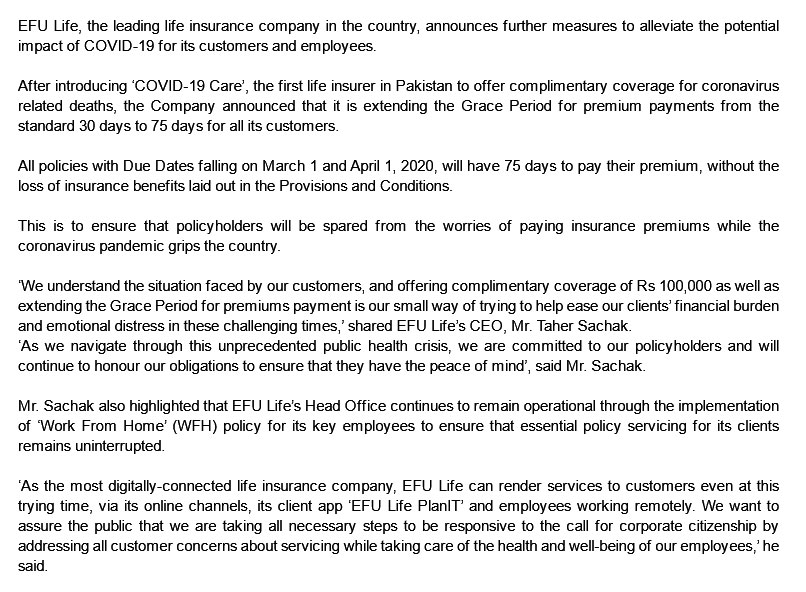

EFU Life, the leading life insurance company in the country, announces further measures to alleviate the potential impact of COVID-19 for its customers and employees.

After introducing ‘COVID-19 Care’, the first life insurer in Pakistan to offer complimentary coverage for coronavirus related deaths, the Company announced that it is extending the Grace Period for premium payments from the standard 30 days to 75 days for all its customers.

All policies with Due Dates falling on March 1 and April 1, 2020, will have 75 days to pay their premium, without the loss of insurance benefits laid out in the Provisions and Conditions.

This is to ensure that policyholders will be spared from the worries of paying insurance premiums while the coronavirus pandemic grips the country.

‘We understand the situation faced by our customers, and offering complimentary coverage of Rs 100,000 as well as extending the Grace Period for premiums payment is our small way of trying to help ease our clients’ financial burden and emotional distress in these challenging times,’ shared EFU Life’s CEO, Mr. Taher Sachak.

‘As we navigate through this unprecedented public health crisis, we are committed to our policyholders and will continue to honour our obligations to ensure that they have the peace of mind’, said Mr. Sachak.

Mr. Sachak also highlighted that EFU Life’s Head Office continues to remain operational through the implementation of ‘Work From Home’ (WFH) policy for its key employees to ensure that essential policy servicing for its clients remains uninterrupted.

‘As the most digitally-connected life insurance company, EFU Life can render services to customers even at this trying time, via its online channels, its client app ‘EFU Life PlanIT’ and employees working remotely. We want to assure the public that we are taking all necessary steps to be responsive to the call for corporate citizenship by addressing all customer concerns about servicing while taking care of the health and well-being of our employees,’ he said.